Easy money saving challenges

Written by

Wednesday 20th December 2023

There’s no doubt about it – saving money can be tricky. Most of us know it’s important to have some cash saved for a rainy day. In fact, experts advise having at least three months’ worth of living expenses put aside. But with so many demands on our money, it can sometimes seem impossible to save up.

We’re sharing our favourite challenges to help you build up your cash reserves. Let’s get saving…

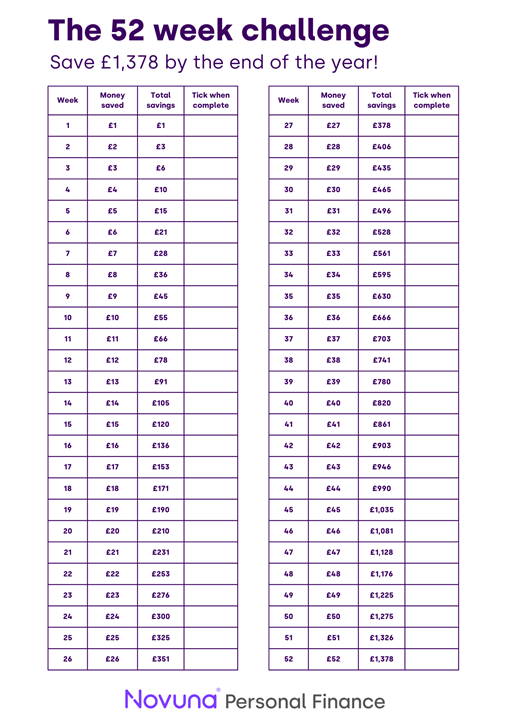

The 52 week money challenge

This is one of the most popular money saving challenges, helping you set aside a certain amount of money each week for a full year.

You’ll save just £1 in the first week, £2 in the second, £3 in the third and so on until you save £52 in the final week. It’ll be harder to put extra money aside as you move through the year, but it’ll be worth it when you end up with £1,378 saved up.

If you want to tackle the hardest part of the challenge head-on, why not reverse it? Save £52 in the first week and work backwards instead.

Download our 52 week challenge calendar to get started...

Monthly money boost

Similar to the 52-week challenge, you’ll gradually build up how much you save over time. In January you’ll save £10, in February you’ll save £20 and so on until you aim to save £120 in December.

Stick to it and you’ll have £780 saved up by the end of the year. Download our monthly tracker so you won’t forget to save...

Save up each day

Whether you can afford to save £1 each day or want to up the ante and challenge yourself to save a larger amount, this is a great way to get into the habit of saving.

It’s simple – either set aside a certain amount of cash each day or transfer the money you’ve vowed to save into your savings account on a weekly basis. You’d be surprised how quickly money can build up over a year.

Swap to save

This is a great way to work with family and friends to save. Write out a list of things you need or want, and items you no longer need but that might be useful to someone else. Compare your shopping lists and trade items between the group.

The no-spend zone

You’ll need some pretty good restraint for this one. Enter a ‘no spend zone’ for a set period, where you won’t spend a penny apart from absolute essentials. Maybe start off with not spending for a couple of days, then build it up to a whole week.

This is a great way to see where you usually overspend. You might not realise how much you impulse buy or how much your daily latte costs each morning until you take on this challenge.

Write down your essential payments, so you know how much you’ll have left at the end of the month. If you come across another essential payment as you enter your ‘no spend’ period, make sure you add it to the list so you can keep track of exactly where your money’s going.

Save money indirectly by altering your day-to-day

If putting cash aside isn’t do-able for you right now, you could save money simply by making a few changes to your day-to-day:

- Try a digital detox. If you’re tempted by social media ads and online shops, take a break from digital distractions for a set period to break the habit.

- Go without a car for a week. By walking or cycling instead, you can get some fresh air and improve your fitness while also saving money on driving costs.

- Ban the brands. Only buy supermarket own-brand products – which are usually much cheaper – for a few weeks or months. You might even end up finding a new favourite product.

The benefits of a savings challenge

Research suggests that about 35% of UK adults either have no savings at all, or savings of less than £1,000. Be part of the 61% who save money most months instead and you’ll soon find your savings building up.

There are loads of reasons why a savings challenge is a good idea:

- Be an active saver

When’s the last time you thought to yourself ‘I’d best put some money into my savings account?’ We often think about spending a lot more than we do about saving. Taking part in a savings challenge is a great way to remember to put some money aside.

- Set yourself a goal

Some people need a set goal to work towards, and savings challenges offer this. Putting aside random amounts at random times might not work for everyone if there isn’t a clear target amount in sight. So decide how much you want to save and by when… and make sure you stick to it.

- Turn saving into a habit

It’s tough to stick to things sometimes but, once you get going with your challenges, you’ll soon find it becomes the norm to set some money aside. You’ll feel even more motivated to keep going once you see your savings build too.

- Get used to budgeting

Are you challenging yourself to evaluate your spending? Knowing how to effectively manage your budget is so important, so the sooner you can start getting your finances in order the better.

- Look forward to building your savings

If you’re faced with an emergency, not having the savings you need can be extremely stressful. If you have even a small amount saved up, you may feel in a better financial position when there are additional demands on your money.

What if I need money sooner?

If a big purchase is on the horizon and you don’t want to dip into your hard-earned savings, a personal loan could be an option. This allows you to borrow the money you need upfront and pay it back over a series of fixed-rate monthly instalments. While you should never borrow money you might not be able to afford later down the line, using a loan can help you get the things you need much sooner.

Borrow from £1,000 to £35,000 over 2 to 7 years, at low rates from 5.9% APR Representative (£7,500-£25,000). Use our online loan calculator to get a quote.

Written by

Luke Hilton is a Warrington-based email content writer and designer in the financial services industry. He enjoys mixing analytics and creativity and can usually be found with his head buried in stats, piecing together the patterns that make good content. In his spare time, the drive to figure things out continues with what can only be described as a love-hate relationship with DIY. With a keen love of the outdoors, Luke is usually up a mountain somewhere or in his garden growing his own oasis.