Steps to improve your credit history

Written by

Wednesday 5th July 2023

Your credit history is made up of lots of different factors. You may find that late or missed payments, or even something as simple as not being on the electoral roll, might contribute to a poor credit score.

The good news is that credit scores are ever-changing, and you can work to improve your credit score over time.

In this guide, we’re looking at actionable ways you can try to improve your credit history.

What is a bad credit history?

A bad credit history simply means your credit report shows negative information. It could indicate you’ve had financial difficulty in the past or show that you’ve mismanaged debt.

Your lenders will provide credit reference agencies (the main ones being Experian, Equifax and TransUnion) with information monthly, including details on your outstanding balance and your current payment status. This ensures your credit report is continually up to date and an accurate reflection of your current circumstances.

Finance providers use your credit report to evaluate the likelihood of you paying back any money you owe, often assigning you a credit score to assess the specific risk of an application. Therefore, having a bad credit history could affect your ability to borrow money. It could flag you as a higher risk applicant, resulting in more expensive rates or even a declined application.

Remember that having a bad credit history is not a reflection on you personally. It’s simply a record of your financial behaviour and how you’ve handled credit in the past.

What causes a bad credit history?

Missing repayments or making late payments, just paying the minimum amount off your credit card each month or legal actions (such as County Court Judgements, Individual Voluntary Agreements and bankruptcy) are just some of the things that can contribute to a bad credit history.

You may also have a poor credit score if you have a thin credit file (which means you have a limited history of borrowing money), although there are many ways you can build up your credit history in this case.

How long does a bad credit history last?

Negative information, such as missed or late payments, will stay on your credit report for six years. Though it can be difficult to improve bad credit history during this time, there are steps you can take to start to improve your credit score which could put you in a better position when applying to borrow money.

Truthfully, there are no set rules on how long it will take for your bad credit history to improve. It’ll be much easier to recover from high credit card utilisation, for example, than it will be to recover from bankruptcy being recorded on your credit report. You can always use a free credit score checker to give you an indicative idea of how lenders might score you during the loan application process.

How can I get a loan with bad credit history?

Since negative information stays on your credit report for at least six years, it’s normally best to wait until you have a stronger credit history before applying for a loan or other product. This allows your credit score to build again naturally over time.

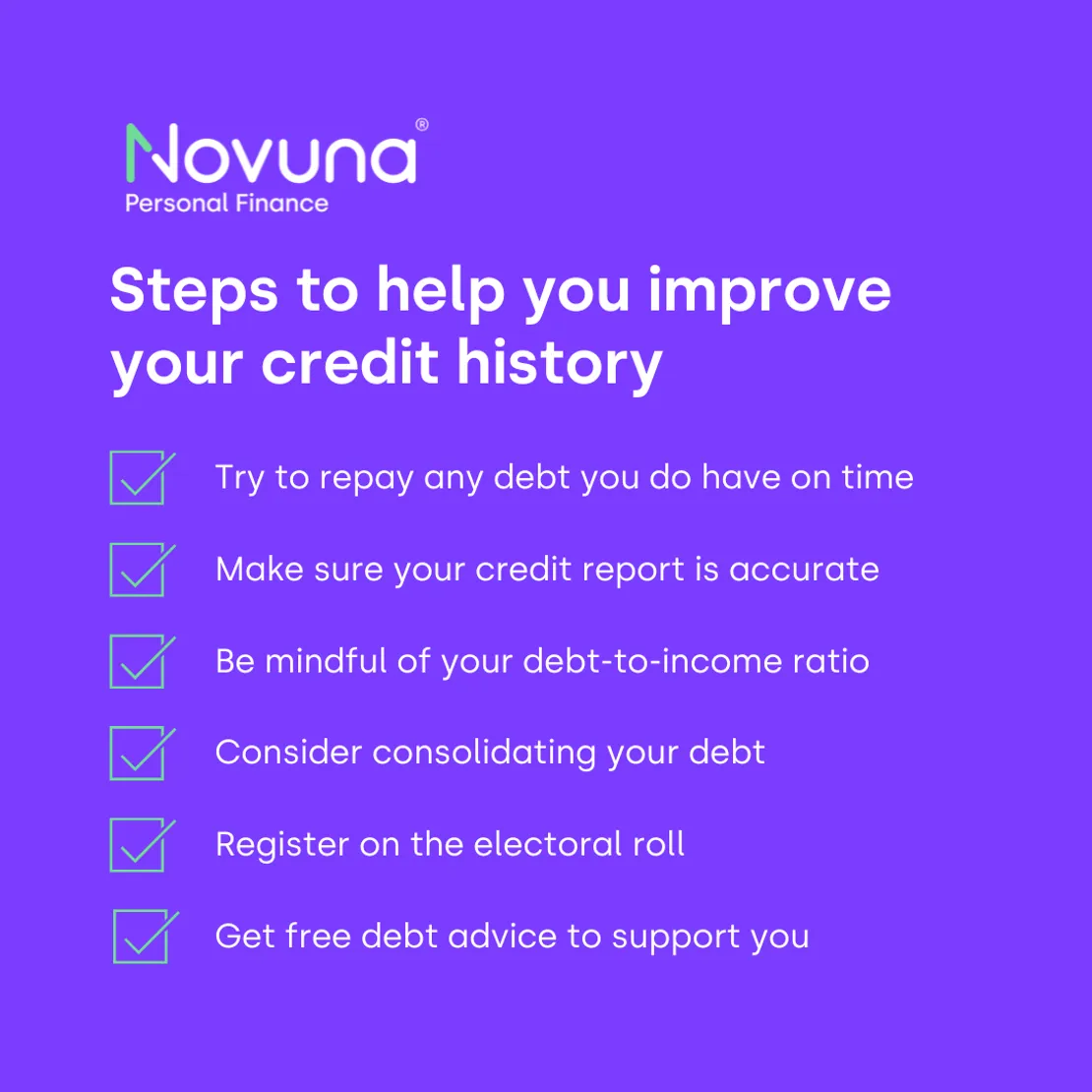

However, if you do have genuine need to get a loan, here are 9 tips to help you improve your credit history.

1. Set realistic expectations

If you are accepted for a loan, you will almost certainly pay a higher rate due to you being a higher risk customer.

Research the type of credit you’re likely to be accepted for. For example, those with a bad credit history are unlikely to be the target demographic for a low APR loan, so it may be easier for you to get accepted for a credit card or higher APR loan. Make sure you understand the costs involved before taking on a loan with high interest rate, as you will end up paying much more than you originally borrowed.

Remember, though, that every lender is different. There’s no such thing as a universal credit score so, while one lender may decline your application, another may be willing to accept you. Don’t apply with lots of different lenders at once, though. Too many credit applications dinging your report with hard credit checks in quick succession suggests you’re perhaps struggling to find credit, or in financial difficulty. This could be a red flag for a lender even if you’re simply applying for lots of loans to research the best rate.

2. Ensure your credit report is accurate and up to date

You can obtain free copies of your credit report from each of the main credit reference agencies. If you're looking to identify ways to improve your credit score, this could be well worth doing. Pay particular attention to:

- Latest updates

Since lenders only provide information to credit reference agencies on a monthly basis, and it can sometimes take a few more weeks to process, any new information can sometimes take a while to appear on your report.

If you are considering applying for credit, it could be a good idea to check your credit report to ensure it’s up to date. This will give lenders the most accurate overview of your financial state of play.

- Any inaccuracies

Inaccuracies or mistakes on your credit report could obviously give a false impression to potential lenders which could unnecessarily damage your chances of being accepted for credit. If you spot any mistakes, promptly raise your concerns with the lender involved.

- Signs of fraudulent behaviour

Look out for information you don’t recognise on your report, as this could be a sign of fraud and should be investigated as soon as possible. Credit accounts you aren’t familiar with, being linked to an address you don’t recognise or several ‘hard’ credit checks you didn’t request could all be signs of fraud.

If you do spot any red flags on your report, contact your lender and report it to the relevant credit reference agencies as soon as possible.

3. Be mindful of your debt-to-income ratio

Many lenders will compare your monthly income with the amount of credit commitments you have (such as mortgages or personal loans) to determine whether you’re in a financial position to afford any additional debt. Put simply, if there’s a chance the new payments will become unaffordable, you’re unlikely to be accepted for credit.

Try to keep your debt-to-income ratio below 40% if possible to improve your chances of being accepted for credit in the future. This basically means that your monthly debt should equal no more than 40% of your monthly income.

4. Repay any debt you do have on time

One of the best ways you can showcase reliability is to pay your existing debt off on time every month. While there’s no way to remove bad information on your credit report, some lenders may focus more on your current affordability and the way you manage your debt now.

Set up a direct debit to pay off your bills and repayments if possible as this will help to make sure you won’t accidentally miss them.

If you have missed any payments due to financial difficulty that you are unable to rectify in the short-term, contact your lending as soon as possible to discuss your situation and agree a repayment plan. Do not wait until you are multiple payments in arrears before doing this.

5. Showcase stability

Lenders like to see stability in your personal life. Register on the electoral roll at your property and ensure all your active credit accounts carry your latest address. This helps credit reference agencies to confirm your identity and creditworthiness.

6. Think carefully before applying for a payday loan

Payday loans might seem like an easy solution if you need money quickly, but they can have a long-term negative impact on your credit score if you don’t keep up with your repayments. In fact, many providers might automatically decline individuals with recent payday loans – even if they were paid back on time.

Payday loans can be expensive too. High APRs often mean you’ll be paying back a significantly larger amount, which could leave you in financial difficulty – particularly if you fail to make your repayments on time.

7. Only take on additional debt if you can really afford to do so

As we mentioned earlier, showcasing improved debt management is one of the best ways to show lenders you’re in a better financial position now. However, you should never take on additional credit solely to try and improve your credit score. If you genuinely need to borrow money, it’s important to only take on a loan if the repayments are sustainable.

You can use a loan calculator to work out how much it will cost you per month (and in total) to borrow the money you need. By extending the loan term, you could reduce your monthly payments. Though this could help to keep the repayments more manageable, you will end up paying more interest this way.

8. Seek third-party advice

There are lots of reasons someone might struggle to repay credit. Personal circumstances may change, you may have unexpected demands on your money or you simply might not have experience managing money.

If you’re struggling to get your finances back on track, free debt advice is available at StepChange. They offer a variety of helpful services, from debt counselling to debt management plans. They could help you to resolve any financial issues in the best way and therefore limit any further damage to your credit report.

9. Consider consolidating your debt

If you’re repaying several high-interest debts, you may be able to consolidate your debts at a lower interest rate – particularly if you can show you’re paying off the debt on time and in full each month. A debt consolidation loan enables you to pay off what you owe, leaving you with just one monthly fixed-rate repayment to think about. This can be a much easier way to manage debt.

For more information on improving your credit score and understanding your credit history, consider bookmarking the Novuna Personal Finance blog.

Written by

Sophie Venner is a Yorkshire-based content writer specialising in crafting content for the financial services industry. She’s written over 300 articles on finance, but she’s covered everything from insurance to digital marketing trends. Her content has been featured in the likes of Semrush, Digital Marketing Magazine and Insurance Business.