Rising EV prices? Why car loans beat car finance in 2025

Written by

Tuesday 26th August 2025

Last updated: 26th August 2025

As the cost of new vehicles continues to climb, especially electric cars, more UK drivers are turning to the used car market. But even second-hand vehicles can require funding, which makes choosing the right finance option just as important as choosing the car itself.

If you’re considering buying a used vehicle, this guide explores why personal car loans can be a more flexible, cost-effective solution than traditional car finance options. We’ve also included the latest UK market data to help you make an informed decision.

Why are new EVs becoming more expensive?

Over the past few years, the average price of new cars has steadily increased. For electric vehicles (EVs), the rise has been even more significant, driven by several key factors:

- Battery technology: EV batteries are costly to produce and make up a large portion of the car’s price.

- Higher manufacturing costs: Research, development, and software integration add to the overall cost.

- Reduced government incentives: Fewer subsidies mean more costs are passed on to the buyer.

- Ongoing supply issues: Global supply chain problems have limited stock, pushing prices even higher.

With new EVs often starting at over £40,000, it’s no surprise many drivers are looking for better value in the used car market.

The case for buying a used car

The used car market in the UK is booming. In Q2 2025, nearly 4 million used cars were sold - up 2.2% year-on-year and now within 1% of pre-pandemic volumes. Drivers are clearly leaning into more affordable choices.

At the same time, the average age of a UK car has now reached almost 10 years, showing that motorists are keeping vehicles longer as affordability becomes a top priority. By the end of 2025, it's expected there will be over 10.1 million cars aged between 5 and 10 years on British roads, up from 8.7 million in 2017.

Why buyers are favouring used cars:

- Lower purchase price compared to new vehicles

- Less depreciation over time

- Wider availability of nearly-new cars with modern features

- Stronger reliability across older models

- Growing stock of used electric vehicles

Used electric vehicle (EV) sales are rising fast

While new EVs can be expensive, the used EV market is growing rapidly thanks to falling prices and broader availability:

- In 2024, used EV sales reached a record 188,382 units, up 57.4% compared to the year before.

- In Q2 2025, nearly 1 in 10 used car transactions (9.7%) involved electrified vehicles, including battery EVs, hybrids and plug-in hybrids.

- Battery electric vehicle (BEV) sales rose 40% in Q2 alone.

- Popular used EVs like the Tesla Model 3 and Kia e-Niro have seen prices fall, making them more competitive with petrol equivalents.

This makes it an ideal time to explore used EV finance through a personal loan - combining savings with environmental benefits.

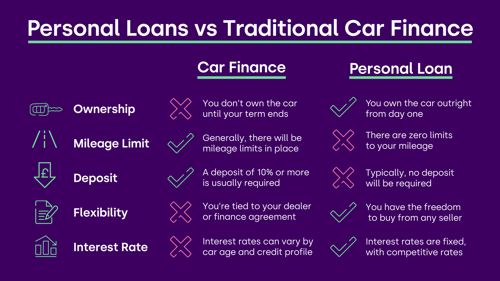

Personal car loans vs traditional car finance

If you're planning to buy a used vehicle, you’ll likely consider either car finance from a dealer or a personal car loan from a lender like Novuna. Here’s how the two compare:

How do personal car loans work?

At Novuna Personal Finance, we make it easy to fund your next car with a straightforward car loan:

- Apply online: Get a quick decision and a personalised quote.

- Get the funds fast: Money can be in your account in a matter of days.

- Buy with confidence: As a cash buyer, you can negotiate a better deal.

- Spread the cost: Choose monthly repayments over 2 to 7 years to suit your budget.

Whether you’re buying from a dealership or a private seller, a used car loan gives you more control from start to finish.

Which cars are most popular in the UK?

Knowing what other buyers are choosing can help guide your purchase. In 2024, the Ford Fiesta was the UK’s best-selling used car for the third year in a row, with over 306,000 units sold, significantly ahead of the Vauxhall Corsa and other rivals.

This reinforces how reliable, compact, and fuel-efficient models continue to hold strong value and remain in high demand on the used market.

The next steps to buying a used car

With the cost of new cars (particularly EVs) continuing to rise, the second-hand market offers better value, more choice, and less depreciation. Add in the rapid growth of affordable used EVs, and it’s clear why more drivers are switching to second-hand options.

When it comes to financing your next car, personal car loans provide greater flexibility, lower costs, and full vehicle ownership from day one. Whether you're eyeing a used petrol model or your first electric car, Novuna is here to help you drive away with confidence.

Written by

Anna Stacey is a skilled content writer based in Lincolnshire, specialising in the financial services industry. With over four years of experience in the digital landscape, she has an aptitude for crafting informative and engaging content that addresses a range of customer needs. Spanning diverse topics, from finance and lending to broader digital marketing trends, Anna is committed to delivering customer-centric content that not only educates but also empowers readers to make informed decisions.