Unsecured vs secured loans

Written by

Tuesday 24th September 2024

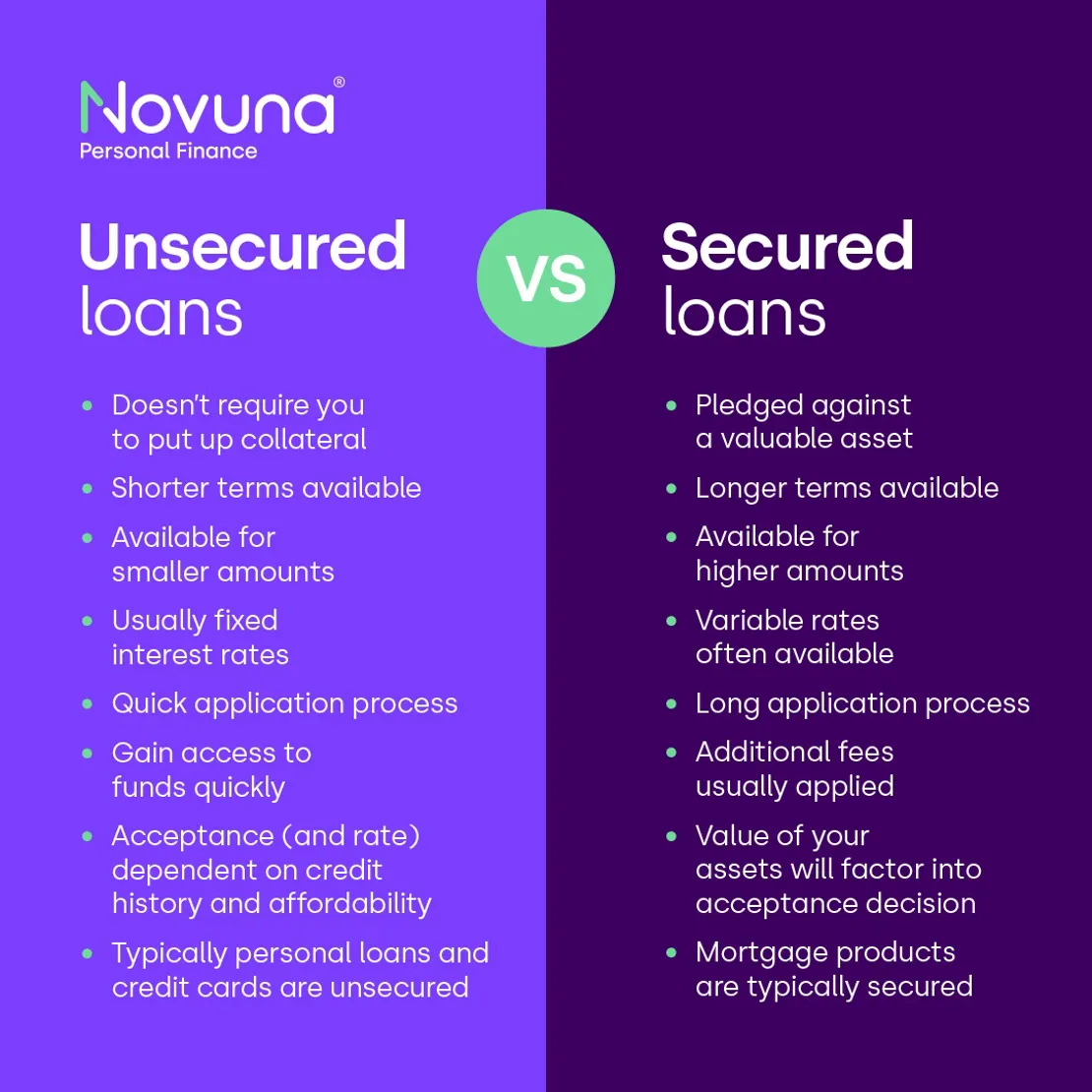

Both unsecured and secured loans allow you to borrow the money you need to achieve your goals sooner. However, each works differently so it’s important you understand the pros and cons before making the decision to apply.

The difference between secured and unsecured loans

An unsecured loan is a type of loan that doesn’t require you to put up collateral as security. Your chosen lender will make their lending decision entirely based on your personal circumstances, your credit history, loan term and amount.

This makes an unsecured loan a good option for those who don’t want to risk their assets. However, failure to repay your loan will impact your credit score and could make it more expensive and more difficult to borrow money in the future.

A secured loan is pledged against a valuable asset such as a house or car. As you’re putting up collateral as a security, you may be able to apply for larger loan amounts over longer terms compared to an unsecured loan. That said, if you fail to make repayments on a secured loan, your lender could repossess your assets to repay your debts.

What is an unsecured loan?

Unsecured loans, more commonly known as personal loans, allow you borrow a set amount of money and pay it back, plus interest, over an agreed timeframe.

Unsecured personal loans don’t require you to put up collateral. Instead, lenders will assess your creditworthiness and paying capacity to determine how much you can borrow and at what rate of interest. Essentially, lenders need to assess how likely you are to repay what you owe.

If you default on your repayments, it will be recorded on your credit file which could make it more expensive or even impossible to borrow in the future. It’s also worth noting that your lender may take legal action against you to enforce you to settle any debt.

The most common types of unsecured lending include personal loans, student loans and unsecured credit cards.

How much can I borrow with an unsecured loan?

Different lenders may offer different minimum and maximum loan amounts and terms (which is the period over which the loan is to be repaid). The max loan amount can vary from £5,000 to £50,000 and the max term can vary from 3 years to 10 years, though many lenders cap these at £25,000 and 5 years.

For a higher loan amount, it’s likely you’ll need a secured loan instead as you may need to offer collateral as security.

Here at Novuna Personal Finance, we offer low-rate unsecured loans between £1,000 and £35,000 with competitive rates from as low as 5.9% APR (£7,500 to £25,000).

Remember that you’re not guaranteed to get the loan amount you’ve applied for. Your lender will assess both your credit history and personal circumstances to determine how much you may be able to borrow.

What are the pros and cons of an unsecured loan?

Pros:

- Flexibility: You can borrow a specific amount of money over a set period at a fixed APR and monthly repayment cost so you can budget accordingly.

- Less risk: Since you’re not securing an asset against the money you borrow, valuable items such as your home or car aren’t at risk of being seized by the lender (although a lender may still take legal action against you).

- Smaller amounts: You can take out smaller loan amounts to suit your needs which prevents overborrowing.

- Easy application process: It’s typically more straightforward to apply for an unsecured loan and you’re likely to be able to gain access to funds much quicker.

- You don't need access to valuable assets: If you don’t own a home or car, but you have a steady income and a good credit score, you may find an unsecured loan a good option.

Cons:

- Higher rates: Interest charges on unsecured loans tend to be higher than those on secured loans because they aren’t backed by collateral.

- Credit dependant: Lenders need to know that their money is going to get paid back in full and within the agreed period. If you’ve got a less-than-perfect credit history, you might struggle to qualify.

- Impact your credit score: If you fall behind on repayments, this could affect your credit score and you may find it difficult to borrow again in the future.

What is a secured loan?

A secured loan allows you to borrow money over a set term, though you must pledge an asset against the amount you wish to borrow. This provides a form of security to the lender.

The value of your assets will be taken into consideration when deciding how much you can borrow and is also likely to affect the interest rate you are given. If you fail to make repayments, then the lender can potentially sell your assets to clear your outstanding balance.

Secured loans commonly include mortgages and certain car finance products. Our car loans, however, are unsecured so you won’t need to secure your car against your loan when you borrow from us.

How much can I borrow with a secured loan?

The amount you can borrow will normally be related to how much you earn (for example, three times your annual salary). The term is usually up to 25 years, though some lenders may offer longer repayment periods. How much you can borrow with a secured loan will also depend on the value of collateral available and any debt currently secured against it.

As with all loans, how much you’re personally able to borrow, how long for and the interest rate offered will depend on your individual circumstances and credit history.

What are the pros and cons of a secured loan?

Pros:

- Borrow more: If you’re a mortgage holder or property owner, a secured loan is a good way to borrow a large sum of money.

- Available to more people: Secured loans are often the only option for people with a less-than-perfect credit history. As your property acts as security, secured loans can be easier to qualify for.

- Longer repayment periods: You can arrange to repay the money you borrowed over a longer period, which might reduce your monthly repayments.

Cons:

- You could lose your assets: If your circumstances change and you are unable to meet repayments, you put your home or car at risk. It is therefore essential you don’t fall behind with payments.

- Variable interest rates: Many secured loans have a variable rate of interest, which means your monthly repayments will increase or decrease depending on the base rate set by the Bank of England. There are secured loans available with fixed rates of interest for at least the initial part of the term, which does allow you to budget during this period as the amount you pay each month does not change.

- Early repayments: Repaying a secured loan early or even making overpayments may incur a penalty charge, particularly if this is done during the fixed interest rate period.

- Increased interest: As you typically pay back a secured loan over a longer period of time, it’s likely you’ll end up paying more interest overall.

- Additional fees: Unlike unsecured loans, expect to pay a lender arrangement fee when taking out a secured loan, which is usually a small percentage of the loan amount. You may also need to pay a broker fee and property valuation fee.

With so many options available on the market, it can sometimes feel a bit overwhelming. But understanding the difference between an unsecured and secured loan can ensure you make the right choice before making an application.

To find out more about personal loans, read our FAQs or bookmark our blog.

Written by

Gillian Brooks is Head of Lending at Novuna Personal Finance. She has over 30 years' experience primarily within Financial Services, spanning product development and marketing for personal loans, mortgages and savings. Gillian developed Novuna’s personal loan product, which launched in 2011, and has seen Novuna grow into one of the UK’s top ten providers.